PM urges revision of business strategies

Published: Thursday | October 22, 2009

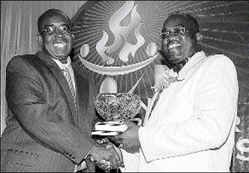

Group Managing Director of National Commercial Bank (NCB) Patrick Hylton (left) presents Evrol 'Blackie' Christian with the NCB Nation Builder Award at the bank's award ceremony held at the Hilton Kingston hotel in New Kingston Tuesday night. - Colin Hamilton/Freelance Photographer

Prime Minister Bruce Golding believes a mindset change is needed when assessing small and medium-sized enterprises (SMEs).

"For too long we've seen small as an intermediate step to large. The world has changed. You can be small but profitable ... robust," Golding said Tuesday night while speaking at the National Commercial Bank Nation Builder Awards dinner.

The award recognises the entrepreneurial performance and community development contribution of SMEs islandwide. This year the Nation Builder Award went to Little Ochie Seafood and Bar.

Pointing out that SMEs were responsible for at least 50 per cent of gross domestic product in some developed nations, Golding opined that demand for some products is best supplied by smaller entities.

Squeezed out

The prime minister said governments tend to get so dependent on borrowing that the private sector gets crowded out and SMEs especially get "squeezed". He lamented the death of creative ideas, conceptualised in those SMEs, that could have made a difference in the country. He called for deliberate strategic information to help these businesses to develop and to be competitive.

Golding highlighted current institutions mandated to assist SMEs, including the Develop-ment Bank of Jamaica and the Jamaica Business Development Corporation, but also reopened the debate on the question of venture capital and expressed a desire for Government to partner with the private sector to make retail lending more small company-friendly. He acknowledged, though, that there are challenges for SMEs to comply with the fundamental business principles without being stifled.

"Lending can never be seen as a welfare programme," he warned. His comments were even more appropriate as, at the same event, Group Managing Director of NCB Patrick Hylton formally announced the creation of the NCB Nation Builder Credit Line.

He said the line was a billion-dollar pool of funds that would be available to small and medium enterprises customers at a rate of nine per cent. He said it was geared towards providing financial support to new businesses, women-owned enterprises and businesses in the agricultural sector.