Kingston Wharves scales back port operation

Published: Wednesday | June 24, 2009

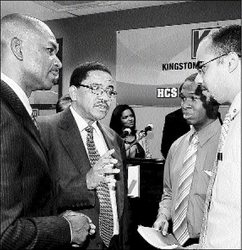

Kingston Wharves Limited (KWL) held its annual general meeting on June 17 at the Kingport Building in Newport West, Kingston. Seen here from left are KWL Director/Company Secretary Roger Hinds and KWL Chairman and Chief Executive Officer Grantley...

Staring at a near 40 per cent decline in cargo movement, Kingston Wharves Limited says it will shutter a 68,000-square foot warehouse within a week at berth five, and is likely to do the same with another 75,000-square foot storage facility until business picks up again at the port.

If the company follows through on the second shutdown of storage space - a decision to be made in two to three months - it will leave just one warehouse, the largest at 88,000 square feet, in operation at berth seven, says KWL Chairman and Chief Executive Officer Grantley Stephenson.

"We are in the process now where we are physically closing one. By the end of this month, that should be closed completely and then we'll start examining another one but the goal is to close two and operate one," said Stephenson.

Cargo will still be stripped at the respective berths but the cargo will be stored at the one warehouse.

The fall-off in business at the port was evident from last year when domestic cargo handled fell nine per cent to 1.84 million tonnes from a peak of 2.023 million tonnes in 2007.

KWL stripped 8,487 containers that year, and handled 22,097 cars, compared with 10,735 containers stripped and 24,982 cars handled in the 2007.

Shipments in the first quarter of 2009 have got considerably worse. Cargo handled amounted to 336,526 tonnes in the January to March period, a 38 per cent decline from the 543,607 tonnes handled during the first quarter of 2008.

Stephenson said normally KWL would handle 800 containers per month but this has declined to 550 containers per month, and with it a fall-off in top-line earnings.

Revenues down

This too is a worsening of last year's position when the company, notwithstanding a fall in cargo volume, ended the year with $2.7 billion of revenue, up by five per cent.

In the March 2009 quarter, revenues were down by more than 13 per cent, from $725 million to $625 million, and KWL which continues to pay out heavy cash - $290 million in this period compared with $25 million in the 2008 first quarter - to service the debt that financed the port's recent expansion - reported a loss of $133 million, compared to a profit of $102 million in the previous year.

Still, KWL's troubles are not unique to the company.

Globally, shipping has hit a slump as world economies tentatively try to work their way out of a deep recession.

This week, however, the World Bank said global output would contract even more than originally forecast - by 2.9 per cent instead of its earlier estimate of 1.7 per cent - suggesting that the world's ports may have to wait another year or more to see business returning to pre-recession levels.

Stephenson says that when the turnaround comes, the warehouses will be taken out of mothballs and put back into operation.

In the meantime, the consolidation of operations would also be used as an opportunity to wring even more efficiencies from the wharf operations.

"We are going to automate all the processes associated with it and we would have more multiskilled people," he said.

The KWL boss anticipates cost savings from the warehouse closures but declined to quantify them, saying only they would be meaningful.

KWL's administrative expenses and cost of doing business topped $2.1 billion in 2008.

dionne.rose@gleanerjm.com