The ruling that Swept Away bank profits

Published: Wednesday | May 13, 2009

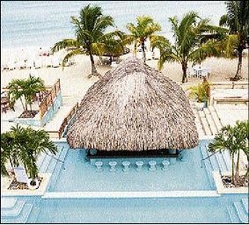

A shoreline view of Couples Swept Away Negril. - File

Last Friday's Court of Appeal decision that rendered hotels' bank-investment income taxable countered the interpretation of Swept Away principals that the profits were untouchable.

Swept Away, a 312-room resort in Negril on Jamaica's west coast, was approved for tax exemption under the Hotels Incentive Act.

Section 9 (1) of the act states: "Any company to which Section 8 applies shall be entitled to relief from income tax in respect of profit or gains arising or accruing during the relevant concession period, from the approved hotel enterprise, of an approved extension of any hotel of which it is the owner, tenant or operator."

The hotel had relied on that section and the Revenue Court agreed that the interest earned on deposits for the years of assessment was exempt from income tax under that act.

The concession period was usually 15 years.

Government withholding tax

Swept Away had maintained a fixed-deposit account into which it placed surplus cash from the hotel business. During the period of Swept Away's concession, that account earned $7.4 million in interest, a portion of which the tax authorities, who assessed the company for the period 1995 to 1999, said they were entitled. Ordinary interest income is subject to a government withholding tax of 25 per cent.

On September 17, 2003, the Taxpayer Audit and Assessment Department advised Swept Away that the interest earned on the deposits was subject to the payment of income tax under Section 5 of the Income Tax Act. Swept Away was dissatisfied with the decision and subsequently took the matter to the Revenue Court and was successful.

The commissioner of taxpayer appeals, who was represented by Patrick Foster, QC, and attorney-at-law Jerome Spencer took the matter to the Court of Appeal. Foster argued that the scope of the relief granted by the act was not as broad as claimed by Swept Away, but extended only to the profits and gains arising directly from the hotel business.

In that regard, it could not include interest income accruing from the deposit of funds in fixed deposit, he said.

Attorney-at-law Allan Wood, who represented Swept Away, argued that interest accrued on the fixed deposit was tax free since the account was an essential incident to the hotel's business. In the circumstance, he insisted, the interest arose from the hotel business.

In handing down its decision, the Court of Appeal said two major issues arose for determination. "Firstly, is interest earned from a bank account to be regarded as profits or gains arising or accruing from an approved hotel enterprise and, therefore, exempt from income tax by reason of Section 9 of the act, or is it income which becomes chargeable and subject to the payment of income tax pursuant to Section 5 of the Income Tax Act?"

The judges said Section 9 of the act made it clear that the source of the profit and gains to be relieved must be the business concerned with operating the hotel and the intention of Parliament was not to relieve all the profits and gains of the business from income tax.

Appeal allowed

The court then ruled that the interest earned on the investment income was subject to the payment of income tax under Section 5 of the Income Tax Act.

The appeal was allowed and the assessment made by the Taxpayer Audit and Assessment Department was affirmed. Costs were awarded to the appellant both in the Court of Appeal and in the Revenue Court.

barbara.gayle@gleanerjm.com