Students' Loan Bureau should follow suit

Published: Wednesday | February 25, 2009

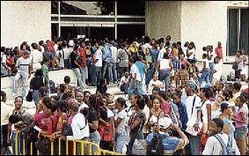

Hundreds of students camp outside the offices of the Students' Loan Bureau in this file photo. - Ian Allen Staff/Photographer

The Editor, Sir:

As the world recession deepens, firms and households are frantically exploring new methods to deal with the current crisis. Several policies have been implemented globally and locally to mitigate the effects of the world recession. Of note is the fact that our two major financial institutions have publicly disclosed that they are willing to talk to their customers to see how best they can assist them through this very challenging time.

I am appealing to the Students' Loan Bureau (SLB) to take a similar approach, look at its operations and see how best it can assist the borrowers during this harsh economic climate. The SLB's policies over the years have imposed and continue to impose severe hardship on its borrowers.

Opportune time

This is an opportune time for the SLB to seriously examine its operations and its mandate to the society. The SLB charges borrowers an interest rate of 12 per cent on funds which it borrows from the Jamaica Bankers Association at 4.6 per cent (7 per cent reducing balance). Borrowers are required to pay an insurance fee of $1.50 per $1,000 per month on initial disbursement and amounts capitalised at the end of the moratorium period, this approximates to 20 per cent of the loan amount. This is in addition to the exorbitant processing fees and other unreasonable penalty charges.

The SLB reports an operating surplus of $519 million for its 2008 operating year. Accumulated surplus now stands at $4.1 billion and its insurance fund now stands at $643 million. All of this happens while borrowers struggle to meet their monthly payments to an institution whose mandate is to assist the poor, bright students educate themselves to contribute to economic and social growth in the country. What an anomaly!

In light of stimulus packages

I believe that, while the Government continues to offer various stimulus packages to businesses in the country, it is an opportune time to assess how to make repayment of students' loan more manageable for young graduates. It is very important that the prime minister address this issue because, when contacted, the Ministry of Finance, which has responsibility for the SLB, seems unaware of the policies and charges of the SLB.

The SLB's exorbitant charges are one 'daggerin' we can do without.

I am, etc.,

Kemmehi Lozer