Sagicor Life buys another 33% of Pan Caribbean, Deal interest in Pan Caribbean to 85%

Published: Sunday | November 15, 2009

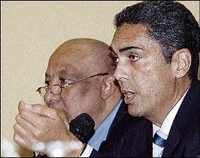

Dodrige Miller (left), chairman, and Richard Byles, president/CEO, Sagicor Life Jamaica.

Sagicor Life Jamaica Limited (SLJ) has increased its stake in Pan Caribbean Financial Services to 85 per cent, buying the additional 33 per cent from parent Sagicor Financial Corporation (SFC).

The deal strips Sagicor Financial of almost all its 182.566 million share holdings in Pan Caribbean.

"SLJ acquired over 181 million Pan Caribbean Financial Services (PCFS) shares over the Jamaica Stock Exchange," said president and chief executive officer Richard Byles in a statement co-issued by Sagicor and Pan Caribbean.

"This increases our ownership from 53 per cent to over 85 per cent."

successful financial entity

The additional stake gives SLJ control of 465.7 million of Pan Caribbean's 547.9 million issued shares.

Byles did not comment on the reason for the purchase nor the value of the deal, but based on the $14-$15.55 trading range for the PCFS stock on Friday, when the trade was recorded on the Jamaica Stock Exchange (JSE), the deal would have been worth about $2.7-$2.8 billion. The JSE reported trading volume of 182.681 million units of PCFS Friday, but Sagicor's announcement of the deal suggests its parent might have retained a tiny fraction of its holdings.

The PCFS stock fell Friday by $1.43 to $14.02 per share, while Sagicor Life rose 19 cents, to $7.01.

"PCFS has been a very successful financial entity, posting increased profits every year for the past seven years and enjoying one of the strongest balance sheets in the financial sector," Byles said.

At the same time that Pan Caribbean and Sagicor Life have been growing, remaining highly profitable even in the recession, Sagicor Financial has been struggling to maintain earnings.

At June 2009, half-year profits were down 11 per cent to US$40.5 million, from US$45.4 at HY 2008, even though revenue was up from US$461 million to US$587 million.

Sagicor Corp's chairman, Terence Williams, in that earnings report, confessed to SFC shareholders that the company was finding 2009 to be an extremely difficult year and was not expecting its position to get any better in the final periods "and maybe well into the new year" because of its exposure to government-issued securities in countries that were increasingly burdened by the recession - Jamaica, Barbados and Trinidad - and placed on negative watch by international rating agencies.

By contrast, Sagicor Life has just announced profit of J$4.5 billion, a 67 per cent premium on the $2.7 billion made in the comparative nine-month period in 2008, while Pan Caribbean's profit was up 23 per cent to $1.1 billion in the same period.

"The acquisition is expected to result in greater synergies and will allow both companies to seek strategic opportunities for efficiencies and expansion," said the Sagicor Life release.

"PCFS and SLJ have worked very closely together over the past four years and this creates an opportunity for us to work even closer," said Pan Caribbean chief executive Donovan Perkins.

Byles said the release that a special transaction committee comprising independent directors of the SLJ board had been appointed to approve and oversee the transaction.

lavern.clarke@gleanerjm.com