Receiver sets US$1.5b target for Stanford investors

Published: Wednesday | November 4, 2009

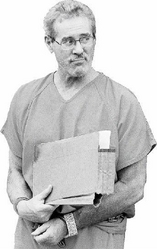

Stanford

THE LAWYER tracking down money lost in what authorities say was a massive Ponzi scheme run by R. Allen Stanford, said he hoped to gain control of more than US$1.5 billion that would be then returned to jilted investors.

Court-appointed receiver, Ralph Janvey, filed a report in federal court in Dallas late Wednesday outlining his plan to go after the US$1.5 billion and provide allegedly defrauded Stanford investors a return of as much as 20 cents on the dollar.

But, John Little, a lawyer appointed to represent investors, said Janvey's recovery goal was "something of a fantasy" and that investors should prepare to get back as little as two cents on the dollar.

Authorities accused Stanford of leading a US$7 billion Ponzi scheme by promising inflated returns to about 28,000 investors on certificates of deposits at his Antiguan bank. The Securities and Exchange Commission (SEC) said Stanford, instead used the money from new investors to pay off old ones. They also accused him of skimming more than US$1 billion to fund his lavish lifestyle.

Stanford denied the allegations. His attorney did not return a message left by The Associated Press.

Garnering for investors

Janvey, who is winding down Stanford's businesses and collecting a pot of money to return to investors, has about US$71 million in cash, on hand. He is pursuing the rest through lawsuits and other means.

According to court papers, Janvey believed he could get as much as an additional US$44 million by liquidating Stanford-owned assets and selling the Stanford Bank of Panama.

Whether the receiver reaches his goal of US$1.5 billion, there are hinges on a federal appeals court approving his plan to pursue nearly US$900 million in claims against investors and former financial advisers.

The appeals court is sche-duled to hear arguments on the case on Monday.

A federal district judge, in July, ruled that Janvey could not go after the principal that people invested in the CDs. The SEC and other parties have asked the appeals court to limit Janvey's ability to pursue claims to people who profited from Stanford's alleged scheme. Janvey also wanted to go after investors who lost money.

Little said he believed a total recovery of around US$150 million is more realistic than the US$1.5 billion Janvey wanted to get, in part because the courts rarely permit a receiver to go after investors who were "net losers". The SEC branded Janvey's plan to sue net loser investors as "an extraordinarily expensive effort" that was "not necessary or appropriate in the first place."

Kristie Blumenschein, an attorney in Janvey's Dallas law firm, acknowledged that "the ultimate success of these efforts was necessarily uncertain."

In other court filings, the SEC was opposing Janvey's latest request for payment for fees and expenses. Janvey asked for US$8.9 million for June through August to pay himself and the large team of lawyers and consultants he hired to wind down Stanford's businesses and unravel his alleged schemes. That would bring his total bill from mid-February to the end of August to nearly US$30 million.

Criminal indictment in houston

Little, meanwhile, filed a request for nearly US$240,000 in fees covering his work from July through September. Janvey opposed Little's fee request, but the SEC, Stanford and other defendants did not.

Besides the civil case in Dallas, Stanford and some executives of the Stanford Financial Group are accused in a criminal indictment in Houston of orchestrating the alleged fraud. Stanford and executives Laura Pendergest-Holt, Gilberto Lopez and Mark Kuhrt have pleaded not guilty to various criminal charges in Houston, including wire and mail fraud.

The three executives are free on bond; Stanford remains jailed.

James M. Davis, Stanford's former chief financial officer, pleaded guilty to three counts: conspiracy to commit mail, wire and securities fraud; mail fraud; and conspiracy to obstruct the investigation.

- AP