Taxed to death - From cradle to grave, Jamaicans hit hard by new tariffs

Published: Friday | December 18, 2009

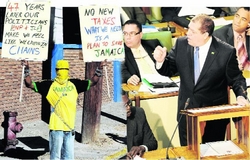

Shackled by taxes? A man (above) stands on Sutton Street, a few blocks away from Gordon House where Finance Minister Audley Shaw (standing right) was announcing the Government's third tax package since the beginning of the fiscal year in April, while Information Minister Daryl Vaz and Agriculture Minister Dr Christopher Tufton (right) look on. The protester wore chains and warned of the social implications of the new tax measures. - photos by Norman Grindley/Chief Photographer

FINANCE MINISTER Audley Shaw yesterday announced the largest tax package of the calendar year as the Government moved to plug a $17.9-billion hole in the Budget.

The package, the third announced by Shaw this fiscal year, is intended to raise $21.8 billion annualised through the medium term.

It brings to $47.6 billion the total tax bundle announced by Shaw since April.

Speaking in Parliament yester-day, Prime Minister Bruce Golding said the move to pull more taxes from Jamaicans was necessary to heal the nation's ailing economy.

No alternative

"There is simply no alternative to raising new taxes," Golding said.

"Not unless we are going to start identifying which school we should shut down, which hospital and clinics we are going to close, which government department that might be providing vital services to people we are going to take out ... we are faced with a situation where there is no alternative," the prime minister added.

Shaw said the $21.8-billion package was "intended to enhance the Government's revenue and curtail the fiscal deficit".

Effective New Year's Day, the standard rate for general consumption tax (GCT) will be increased from 16.5 per cent to 17.5 per cent, a move which Government says will yield $3.6 billion.

But not only will the rate of GCT be increased as the Government has brought all basic food items - with the exception of rice and counter flour - into the GCT base.

Food items such as salt, syrup, cooking oil, noodle soups, meat, ground provisions, sardines, bread, buns, bullas, eggs and sugar are now subject to GCT.

Persons paying for undertaking services will also have to pay GCT on burial, cremation and items such as coffins.

In April, Shaw was forced to remove several items, including salt and syrup, from the GCT list after the Opposition People's National Party protested, calling the move ill-advised.

However, in justifying his actions to broaden the GCT base, the finance minister said yesterday that it was "designed to bring efficiency and remove some of the distortions that are plaguing the system".

He told Parliament that the expansion of the base was a recommendation from the Matalon Tax review committee, which was commissioned by the previous government.

Meanwhile, residential consumers of electricity who consume more than 200 kilowatt-hours of electricity from the Jamaica Public Service Company (JPS) will have to pay GCT on their light bills.

Shaw claimed many residential customers would not be affected.

"Of the 523,000 customers of the JPS, this tax will not apply to 381,000 Jamaicans as they consume electricity below 200kWh per month," Shaw said.

The Government intends to raise $1.2 billion in revenue from putting GCT on residential electricity bills but Shaw said the yield is "the less important point".

"We are sending a message to the consumers of electricity above 200kWh per month. Get into the conservation mode ... treat it as a conservation measure," Shaw said.

Other taxes

The other new taxes announced by Government are adjustments in the special consumption tax on fuel and cigarettes.

Government's move to levy more taxes follows its decision to re-enter a borrowing relation with the International Monetary Fund (IMF).

Jamaica is seeking to borrow more than US$1.2 billion for balance-of-trade support from the multilateral lending agency.

"While we had little or no choice but to go to the IMF, an IMF programme cannot, in and of itself, develop Jamaica," Shaw said.

"Equally, we have no choice but to embark together on a deliberate path of embracing and developing our future," he added.

According to Shaw, had previous administrations adequately grown the economy and reduced the country's debt and interest rates, the Golding administration would not have been forced to swing the tax axe in this way.

For his part, Golding said the Government he leads could not deny Jamaica's retarded state.

"It may very well be that the measures that we have had to adopt have been forced on us by necessity because of the global recession," he said. "If that is the case, then perhaps it is the one good thing that the global recession might have done for us and therefore putting our house in order is top priority."

He added: "We may have lacked the political will before. We may have thought at times that political expediency was more important than the future of this country. The measures that we have announced are tough. They are not likely to be popular. But leadership that strives for popularity is not what the country needs at this time."

daraine.luton@gleanerjm.com