Insurance against uninsured drivers: Is it worth it?

Published: Sunday | November 8, 2009

Insurance Helpline, with Cedric Stephens

Question: ICWI recently introduced protection against uninsured motorists. This is being offered at an additional cost to the basic premium. In one flier, the company stated that being hit by an uninsured driver "could mean paying a deductible, losing your no-claims-discount and having to pay increased premiums." Is it the general practice that if you, as an insured motorist, are hit by an uninsured motorist, even though you are not at fault, you are at a financial disadvantage?

Answer: This is not an advert for ICWI. I am compelled to make this statement. That company's name was associated with this column as a sponsor - something I had absolutely nothing to do with - for a period that ended on August 2, 2006.

Before that took place, I made the decision not to mention the names of the companies that readers wrote to me about. Why? One of the 'big boys' from a major insurer scared 'the daylights' out of me. He threatened me with a lawsuit for libel. My crime: I was reducing the value of his company's brand! In retrospect, I was a big coward.

"Protection Against Uninsured Motorists" was launched by ICWI. It is, therefore, unlikely that that company, given its past association with this column, will try to stop me from offering honest comments about their new add-on.

Uninsured motorists cause many problems. Jamaica is not the only country that is affected by those who decide to break the compulsory motor-insurance law. In the UK, for example, it is estimated that uninsured drivers cost law-abiding motorists £400 million each year.

In the US, some states have limited the damages that an uninsured driver can recover following an accident, even when they are not at fault. Uninsured drivers are barred from making a claim for non-economic damages - typically pain and suffering. They may also face increased liability.

An at-fault uninsured driver may be liable for all damages to another driver's vehicle. Insured drivers may have their liability capped, at say, US$500. Uninsured drivers here beat the system with little risk of sanctions.

chance of a collision

The chance of a collision in Jamaica between an insured driver and one that is uninsured is not rare. This is, I believe, the theory on which the recently launched add-on is based. Local insurers use the rule of thumb that one in four of every vehicle on the roads is uninsured. Since insurers are in the business of paying claims for personal injuries and property damage arising from traffic accidents, I consider this estimate to be reliable.

Last week's column discussed the case of a reader who had the misfortune of being involved in three separate accidents. Even though all three vehicles were insured in compliance with the Motor Vehicles Insurance (Third-Party) Risks Act, the prospect of making recovery from the persons who caused the collisions was only one in three. Two drivers were not entitled to compensation under the contracts of insurance. In other words, the reader would have to find the funds to pay to repair his vehicles and retain the services of an attorney to use the legal system to recover damages, costs and expenses he had incurred because of the fault of the other drivers.

Persons who buy 'comprehensive' motor insurance face additional risks when they have mishaps with uninsured vehicles. They have to find money to pay their deductible (or excess). This normally amounts to five per cent of the vehicle's estimated value. In the case of a vehicle worth $1 million, the excess would be $50,000.

paying higher premiums

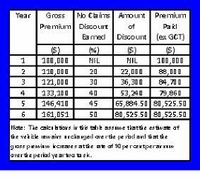

The accident victim would also face the prospects paying higher premiums over the course of many years due to the loss of his or her no-claims discount. Most persons have not done the math and, therefore, do not realise that the real worth of their discount, or that its value, should be calculated over period it was earned - five or six years in the case of the maximum - and not just for a single year. (See table above.)

Is insurance against uninsured motorists worth the extra premium? In my opinion, the answer is absolutely yes. I would definitely buy it for my peace of mind. The Government, like its counterpart in the UK, has its hands full dealing with other problems and, therefore, is unlikely to tackle this problem very soon, even though it is losing millions in general consumption taxes.

Finally, in countries with more effective legal systems than our own, like the US and Canada, this type of insurance has been available for years.

Cedric E. Stephens provides independent information and free advice about the management of risks and insurance. Email: aegis@cwjamaica.com or send (SMS) message to 812-7233.