Jamaica entrenched among worst 10 tax jurisdictions - Companies pay out 51% of profit

Published: Friday | September 11, 2009

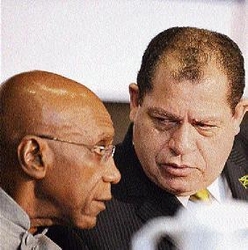

Dr Delise Worrell (left), executive director of the Caribbean Centre for Money and Finance, confers with Audley Shaw, minister of finance, at the 13th annual senior level policy seminar on strategies to cope with the global uncertainty and choices for Caribbean business and finance held at the Jamaica Conference Centre on Friday, September 4. - Ricardo Makyn/Staff Photographer

Jamaica's standing in the global investment community has taken a nosedive, reflected in its slippage in the Doing Business 2010 survey to No 75 of 183 economies, but stands in 10th place among regional countries.

In an area where Jamaica has been traditionally strong - few impediments to starting a business - the country slipped from 12th place among global nations to 19, but was deemed less adept at protecting investors, falling from 70 to 73.

The country - whose current per capita income was estimated in the middle-income category at US$4,870.65 - rose seven places in the subcategory on registering property, linked to the cut in transfer tax from 6.5 per cent of property value to five per cent, but was still low on the totem at position 122.

As for the World Bank/IFC current assessment on Jamaica's tax friendliness, that remained poor, but notched up one place from 175 to 174. The ranking still placed it among the worst 10 tax juris-dictions. Companies in Jamaica are now estimated to give back 51.3 per cent of profit to the Treasury in different taxes in 72 transactions per year.

Comparatively, the Latin Ameri-can and Caribbean region has an average of 33 transactions while the rich OECD countries do 13, while the two blocs respectively pay out a total of 48 per cent and 44.5 per cent of profit in taxes.

Last year, Jamaica was ranked 67th in the revised Doing Business 2009 survey - adjusted from 63.

Top billing

Regionally, the Dominican Republic got top billing for most reforms in the period June 2008 to May 2009, propelling it from 102 in the rankings to 85.

Grenada, St Kitts and Nevis, and St Lucia were also singled out, respectively, for policy adjustments to contract enforcement rules and customs; cross border trade; and company registration. St Vincent was mentioned for improvements in starting a business, while Haiti gained the spotlight for expanding access to credit "by broadening the types of assets that can be used as collateral", speeding up trade documentation and opening up its port operations under a 24-hour system.

business@gleanerjm.com