Calibrating the right dose of 'new IMF' to Jamaica's pre-existing condition

Published: Friday | July 31, 2009

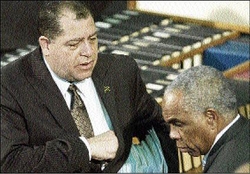

Finance Minister Audley Shaw (left) and Opposition spokesman on fnance Dr Omar Davies are seen here in this April 7, 2007 photo in Parliament. Shaw has confirmed that Jamaica hopes to access US$1.2 billion under the borrowing arrangement being negotiated with the IMF. - File

Recent columns and letters to the editor on Jamaica's likely IMF recourse provide more questions than answers as they grapple with core issues governing international finance: who provides funding, sets and enforces rules?

To grasp this problem though, all we need do is reflect on the role of the former Colonial Office and Whitehall - the idea of 'financial viability' - highlighted particularly during the period immediately preceding federation.

'Financial viability' described a colony meeting Her Majesty's Government annual recurrent expenditure on civil service pay and rations, home leave, road and port maintenance, hospitals and the police, from current taxes, fines, customs duties, et cetera. If a colony faltered, Whitehall sent 'grant-in-aid' covering the deficit.

It was the lender of last resort, no strings attached. Not really. Colonial surpluses were invested by Britain in the Sterling Exchange Standard - no generosity, just doing colonial business.

Do we glimpse similarities to today's International Monetary Fund (IMF)? Perhaps.

Contemplating 'financial viability' was job one for burgeoning West Indian nationalists seeking independence. In the 1950s this conception allowed only the more developed colonies Jamaica, Trinidad, Barbados and British Guiana to qualify as potentially 'financially viable'.

This Colonial Office view became the death nail in Federation's coffin. Bauxite in Jamaica and British Guiana and oil in Trinidad made Britain's Secretary for Commonwealth Relations, Duncan Sandys (pronounced 'sands'), Churchill's son-in-law, suggest these colonies could 'go-it-alone'.

In those days, political independence was a goal transcending everything for nationalists, social democrats and the labour movement. So long as it was a 'no-no' without political union, based on 'financial viability', Federation was the only fête in town. Sandys' comment changed that.

Upon independence it requires no electron microscope, to see and assert that the IMF took on this role minus the fiction of 'colonial responsibility', for newly independent countries like Jamaica.

We had no need for IMF support until the oil shock of the early 1970s.

Social programmes

Yet the bauxite levy and the notion that producers - the International Bauxite Association - could sustainably mimic operations and financial gains of the Organisation of Petroleum Exporting Countries led us to craft budgets with admirable social programmes meant to better the condition of the people.

In this thinking we were wrong.

Furthermore, just as Cold War beliefs and intrigue made a mockery of internal self government for British Guiana in 1953, so too did they present a frigid glare to Jamaica's friendship with Cuba and active participation in Non-Aligned Movement goals of the 1970s.

Facing deficit crunch and foreign exchange shortage, our IMF programme terms made Shakespeare's Shylock appear the essence of compassion.

Yet as some did then, and some will now do, can we honestly blame the IMF for our condition? Ours then, was a pre-existing condition, as it is now. Banks pursue solvent, liquidly asset-rich clients, charging prime rates for borrowing. To those who have, more shall be offered if not plainly given.

This holds for companies like General Electric (GE) as for countries like Argentina and Jamaica.

It was Palmerston, diplomat and Queen Victoria's Prime Minister, who said Britain had neither permanent allies - friends - nor permanent enemies, only interests. Nothing has changed.

That is the essence, for both national and global financial operations, of capitalism's drive for accumulation. The IMF was not designed with formerly exploited colonies' well-being in mind.

This is what prompts David Wong in a Gleaner Op-Ed of July 2 to ask whether Don Robotham thinks the purpose of G-20 is to provide for countries like Jamaica "to borrow with abandon?"

Wong suggests that Robotham doesn't properly analyse global capitalism and therefore "is incapable of rising above the charge that the global economy is unfair to the underdeveloped countries" exhibiting "economic double standards".

But we need to take the point further: Keynesian counter cyclical economic policy superimposed upon Jamaica's existing economic structure and socio-economic arrangements shall take us nowhere but deeper into the morass.

Robotham's prescription is to mount Facebook, Twitter and YouTube publicity campaigns because, he says, "let no one fool you, the IMF and the World Bank hate negative publicity".

Financial viability

He advocates "exposing their hypocrisy to the entire world". Yet the IMF and World Bank, their chiefs' wishes to the contrary, cannot twist G-20 arms.

Such an initiative shall bear no success.

Our one and only lasting solution rests in achieving 'financial viability'. Government revenue must minimally, meet expenditure commitments.

To do this requires identifying sources of chronic deficits, immediately addressing them. They include inefficient government operations, corruption and resource misallocation; abundant subsidies mandated by political clout of private business, often opaque to the general public; inefficient private sector operations made partly unavoidable by bureaucratic red tape; an ingrained partisan political structure rewarding support and not successful effort.

There's a positive list too, associated with sources of economic growth.

Closure of the deficit gap must come from both scissor blades - GDP growth brings expanded revenue.

Collin Bullock in a July 5 Gleaner article titled 'Jamaica and the 'new' IMF', lists changes in IMF policy approaches allowing us to use loans as bridging finance while we streamline budgeting for surplus generation.

Among the six major changes, three key ones are: retreat from devaluation castor oil regardless of whether school's out, rigid ratios as numerical targets and pre-conditions.

These new 'rules' allow flexibility defining our programme.

Just like a family with children whose major breadwinner loses a job, claiming unchanged capacity to provide college education for all in the absence of a fund insured against job loss, for Jamaica to use IMF funding to continue as usual would be folly. Furthermore, it could not gain IMF approval.

The banker still requires persuasive evidence of the client's ability to repay. Shylock may have converted to Catholicism at last but his pound of flesh is still required.

Shylock also is convinced his repayment is safe, as if approaching GE will release even more funds than we need, perhaps at prime rate.

Persaud

wilbe65@yahoo.com