'Not business as usual at Customs'

Published: Sunday | July 19, 2009

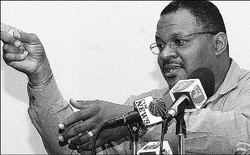

Danville Walker, Contributor

The C78X form is the favourite method used by some importers to bring goods into Jamaica. Why? First, you are not required to have a tax compliant certificate (TCC), and also it does not require you to declare your invoice to Customs before arriving at the port.

So importers turn up at the wharf with an invoice that is supposed to be for the goods and the officer there is to make a judgement on valuation as well as to check the quantities that importers claim they have shipped.

When officers dispute the values (unit cost) of items they are threatened and abused. In a recent case, an officer was shot at and his car riddled with bullets because he refused to accept 500 bags of refined cornmeal on a C78X form. In the same month another officer was told by a thug from a well-known garrison that he is going to personally watch her beg him for her life because she would not accept his goods at the valuation he had stated.

No statements

These are daily occurrences on our ports and many of these persons who threaten Customs officers come on the port, especially in Kingston, regularly and actually are broker agents for licensed custom brokers. In our culture of 'informer fi dead' reports are not made and statements not gathered. Hence, these thugs and their cronies roam the ports as the agents for informal commercial importers (ICIs) and others who seek to dominate the distributive trade. If left unchecked this will become the main method of importation and the tax-compliant businesses will be driven from the market.

Of course, there are some customs officers who do not have a difficulty with this system because, for a price, they simply will allow anything to be cleared on a C78X and they make life even harder for their fellow officers as they are seen as efficient and cool and people you can work with. In Customs they are referred to as 'shotta officers'.

The decision

We have to decide, and quickly, whether we want a formal distributive importation system, from which proper taxes can be collected, or if the free for all that ICIs and shopkeepers want to continue.

Please don't make the mistake of thinking that it's just the ICIs who use the C78X for their goods. Many large shopkeepers simply fragment their shipments since the C78X is supposed to have an upper limit of US$3,000. Aliases and associates are used along with a Customs version of a power of attorney to complete the picture. This 'system' is being perpetuated oftentimes by broker agents who are former customs officers and this makes the battle even harder to fight.

Many in their deep wisdom simply love to say that if Customs just simply does its job then all would be fine, as we at Customs have to be complicit for this corruption to take place. The real problem is that some of our officers have, over the years, facilitated this and profited handsomely from it. These are arguments that are hard to rebuff. It is also true that good officers who would resist many times find themselves alone and threatened if they do not play ball. In this regard, management at all levels is duty-bound to give support to staff who are honest and are willing to stand up to the thugs and resist efforts to corrupt them and Customs systems. We cannot be hamstrung by fear or our economic handicap.

We have to fix this and prayer alone is not going to cut it. We have to cut out what does not work. We have to declare the right invoice amounts and pay our duties. All of us.

Many have made fortunes selling counterfeit and duty-free cigarettes, bleaching creams, and duty-free alcohol, bringing goods into a free zone and selling it into the general market and not paying duties, etc. We are getting tougher at Customs so as to create a level playing field.

Corrupt distribution

We cannot continue to be so myopic as to give free zone status to a company simply to make the real estate attractive, and then when it is used as a staging point for the corrupt distribution of goods into the economy it is dismissed as a Customs problem. Actions like those fuel the scepticism and cynicism that run deep when trying to address these problems.

The fight against corruption in Customs is not going to be won through a cowardly approach. My only fear is that more persons will not join in. Practices that are deep-seated require deliberate and bold measures to root them out. We are committed to the tasks at hand and we will not relent in our efforts to have sound systems and procedures in Customs that are fair and efficient.

Danville Walker is commissioner of customs. Feedback may be sent to columns@gleanerjm.com