Lascelles untouched - Duprey remains chairman

Published: Wednesday | June 17, 2009

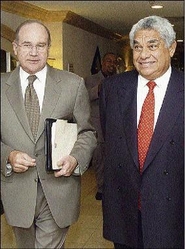

William McConnell, managing director of Lascelles deMercado, and Lawrence Duprey, chairman of CL Financial, at a luncheon meeting in January 2008 to woo investors to take up the CLF's offer to buy Lascelles. - File

There is no danger of Lascelles deMercado being sold off to pay the debts of CL Financial group, the Trinidad parent who is also holding that the government, which has taken command of Lawrence Duprey's outfit, has not by virtue of that takeover become the owner of the Jamaican conglomerate.

The Trinidad government will step in for at least three years, but CL Financial still owns the assets of all the companies, said its group Financial Director Michael Carballo.

"So the question of selling does not arise," he added, referring in this instance to Lascelles.

Carballo has long said the spirits assets of the group remain untouched by CLF's troubles, which has largely been a failure of the financial and insurance businesses reposited in CLICO, CLICO Investment Bank, and British American Insurance Company.

Still, other assets such as the 55 per cent shareholdings in Republic Bank Limited, its 56.33 per cent in Methanol Holdings Limited (MHTL), Caribbean Money Market Brokers Limited, have been put up for sale to free liquidity in the over-leveraged group.

It's the proviso that 'any other assets' would, if necessary, also be sold to meet the Statutory Fundobligations of CL Financial affiliates that keeps brokers in Jamaica concerned that Lascelles and its parent, Angostura, are not immune to the troubles of the ultimate parent.

In Kingston, the corporate home of Lascelles deMercado, group managing director and board members of the spirits conglomerate, William McConnell, told Wednesday Business that the company still belongs to its shareholders, including some 1,500 investors here in Jamaica.

"I can't say that," he reacted when asked by Wednesday Business whether Lascelles, if only temporarily, had not effectively become the property of the Trinidad Government.

Insurance-based company

"Lascelles is owned by shareholders, some of whom are companies within the CL Financial group, some of whom are the 1,500 shareholders here. I owe a duty to all shareholders, and I run the company for the benefit of all shareholders," McConnell said Tuesday.

Duprey, 74, who transformed his enterprise from an insurance-based company to a conglomerate of 65 companies in 34 countries, has bowed out as chairman of CLF, but remains chairman of Lascelles.

McConnell said up to Tuesday he had got no indication to the contrary.

The agreement Friday between Trinidad and CLF gives the government four directorships on the new CLF board, including former central bank governor Euric Bobb, who replaces Duprey.

Shareholders representing over 67 per cent of the shareholding of CLF, including the majority shareholders, have indicated their support of the appointment of new directors Bobb, Shaffick Sultan Khan, Steve Bideshi, Alison Lewis, Michael Carballo, Andrew Mitchell, QC, and Steve Castagne.

Shareholders

Carballo said the government was in control of the management and running of the Caribbean conglomerate, but what has not changed is the ownership.

"The shareholding hasn't changed. There is no intention to change the shareholding. It's an agreement for about three years whereby the assets are managed and restructured and then the company will be returned to the shareholders," he said.

Lascelles was acquired by CLF in 2008, but still has some 1,500 minority shareholders according to McConell.

The US$9.25 per share deal was sealed just six months before CLF troubles were made public. In the post-mortem of the collapse, the new debt that CLF assumed to help pay for Lascelles was identified as one of the final straws.

Trinidad's Ministry of Finance said the agreement reached Friday with CLF would lead to the correction of the financial conditions of CLICO, BAT and CIB; protection of the interests of policyholders of CLICO and BAT and third party depositors of CIB; and deleveraging the CLF group are repaying the government.

"The MOU imposes requirements on CL Financial to sell its assets in order to repay GORTT for advances and other costs arising from closure of CIB and the restructuring of CLICO and BAT. The achievement of this objective requires continuing goodwill, cooperation and participation by CLF over a period of several years, since there is no intention of engaging in a fire sale of CLF assets," the ministry said.

The new board is empowered to improve governance in CLF and its subsidiary companies; negotiate with creditors of both the parent and subsidiary companies to secure appropriate debt restructuring and to repay government and creditors from proceeds of the asset sales.

business@gleanerjm.com