Red Stripe sales still falling, but profit grows 29 per cent

Published: Wednesday | May 13, 2009

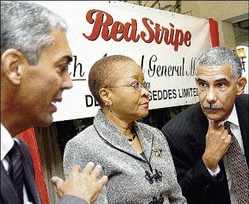

Richard Byles (left), chairman of Red Stripe, in discussion with Mark McKenzie, managing director, at the company's 89th annual general meeting held October 31, 2008, in Kingston. At centre is company secretary, Gene Douglas. - File

Desnoes and Geddes Limited, trading as Red Stripe, clawed $1.1 billion of profit from sales during the nine-month period ending March 31, which amounted to an additional $150 million of net income over the previous year, notwithstanding a seven per cent decline in volumes within the period.

The company's Jamaican sales tanked 19 per cent in the review period, but the depressed demand at home was mostly offset by a 23 per cent increase in its export markets.

Red Stripes' turnover was also up, though not by much - growing only six per cent to $9.86 billion, or just under $3.3 billion per quarter.

Jamaica continues to command the lion's share of the company's markets, pulling in $7.29 billion in gross sales - $5.96 billion after special consumption tax - while exports captured the other $2.56 billion.

Most vibrant market

Red Stripe, which markets beers, sodas and other beverages, said the lower volumes were offset "by price increases taken across both the domestic and export markets."

The United States remained its most vibrant market, growing 23 per cent in the third quarter, and 26 per cent across the nine-month period.

Red Stripe's 29 per cent growth in net profit - the company made $853m in the similar 2007/08 period - was due mostly to the containment of marketing and selling expenses, which dropped by $170 million to $1 billion.

Much of that spend, $620 million, was in Jamaica to pay for new marketing campaigns for Red Stripe beer and Guinness, the company said in a statement accompanying the accounts, co-signed by chairman Richard Byles and managing director Mark McKenzie.

The cost of producing its beverages also rose by about $380 million to $5.1 billion, pushed by inflation and higher raw material prices, but also mitigated by "production and procurement efficiencies," said Red Stripe, whose net worth was estimated at $7 billion in the review period or $2.52 per share.

The DG stock traded down one cent to $3.99 Tuesday, placing its market value at $11.2 billion.

business@gleanerjm.com