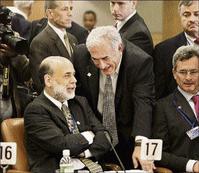

International Monetary Fund (IMF) Managing Director Dominique Strauss-Kahn leans over to speak with US Federal Reserve Chairman Ben Bernanke (centre), at the opening of the International Monetary and Financial Committee meeting at IMF headquarters in Washington, Saturday. - AP

WASHINGTON (AP):

Financial officials from the world's wealthiest industrial countries are pledging decisive action to deal with the biggest upheavals to hit the global financial system since the Great Depression.

The big question is whether their one-page action plan will be enough to stop the bleeding as investors watch trillions of dollars of wealth melt away.

In an effort to expand the firepower the United States is bringing to the problem, Treasury Secretary Henry Paulson announced late Friday that it had decided to go forward with a plan to buy a part ownership in a broad array of American banks. It would be the first time the US government has employed such a programme since the 1930s.

Resolving current crisis

US President George W. Bush invited Paulson and Federal Reserve Chairman Ben Bernanke and their counterparts from the other G-7 countries to come to the White House Saturday morning for a meeting that the administration hoped would demonstrate global resolve in attacking the current crisis.

Bush, speaking on the economic chaos for the 21st time in 26 days, said Friday that the government's rescue programme was aggressive enough and big enough to work. "We can solve this crisis and we will," he pledged.

The G-7 officials wrapped up three hours of closed-door talks Friday with one of the shortest joint communiqués in the history of the group. It was also the most direct in its promise to take "all necessary steps to unfreeze credit and money markets" to end a severe credit crisis that began in the US a year ago but since, has spread worldwide and has grown in strength.

Banking system frozen up

Fears that banking systems had essentially frozen up have sent worried investors rushing for the exits. The Dow Jones industrial average just completed its worst week in history and has plunged by nearly 2,400 points over the past eight trading sessions. Over the last year, investors have suffered US$8.4 trillion in paper losses.

In the midst of all that carnage, the G-7 countries - the United States, Japan, Germany, France, Britain, Italy and Canada - sought to strike a determined tone to do what they could to combat the problem in their countries.

The finance officials have already injected billions of dollars of reserves into their banking systems with little effect so far. As the markets plunged this past week, however, the US and other countries accelerated their efforts.

The administration is working overtime to get a $700 billion rescue programme that Congress passed just a week ago into operation. The programme's main goal is to buy billions of dollars of bad mortgage-related loans from banks and other financial institutions in an attempt to restart more normal lending operations.

But on Friday, Paulson said the administration would open up a new avenue of attack with a programme to purchase stock from a wide variety of banks and other financial institutions, hoping that by injecting fresh capital it will get credit - the lifeblood of the economy - flowing again.

Pouring cash into troubled banks

Earlier this week, Britain had moved to pour cash into its troubled banks in exchange for stakes in them - a partial nationalisation. Paulson said the US programme would be designed to complement banks' own efforts to raise fresh capital from private sources.

The G-7 statement endorsed a programme to prevent the failure of major banks in each of the countries, unfreeze credit and money markets, bolster capital and deposit insurance programmes and get the battered mortgage financing system operating more normally.

It was the meltdown of the subprime mortgage market with cascading defaults that triggered the start of the credit crisis in the United States in August 2007.

While the G-7 group did not endorse all the plans put forward, such as a proposal from Britain that countries guarantee the loans banks make to each other, the finance ministers said they believed they had agreed on a comprehensive plan that would show results.

French Finance Minister Christine Lagarde called it a "coordinated, synchronised and rightly timed approach", while German Finance Minister Peer Steinbrueck said that quick implementation was critical because "the downward spiral is picking up speed".

Dealing with the problem

An even larger group of 20 countries - which include the wealthiest and the world's biggest developing nations such as China, Brazil and India - met with Paulson on Saturday evening.

The question of how countries can deal with the spreading financial crisis was dominating discussions at the weekend meetings of the 185-nation International Monetary Fund and its sister lending institution, the World Bank.

Mark Zandi, chief economist at Moody's Economy.com, said he believed that markets will stabilise in coming days as long as the new programmes produce positive results in getting credit flowing again.

"At this point, policymakers have said a lot and done a lot. Now markets will want to see whether it will work," Zandi said.