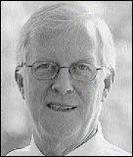

( L - R ) Willumstad, Sullivan

American International Group Inc, which has lost billions on bad bets on the mortgage market, on Sunday named former Citigroup executive Robert Willumstad to replace the insurer's besieged chief executive.

Willumstad, 62, will take over from Martin Sullivan, 53, effective immediately, the company said.

Stephen Bollenbach, the former CEO of Hilton Hotels Corp, will be named AIG's lead director.

AIG named Willumstad chairman of the board in fall 2006, about a year after Willumstad left his post as president and chief operating officer at Citigroup. Citigroup had passed him over for the CEO job - which went instead to the now-dethroned Charles Prince.

Sullivan, a native of England who had worked with AIG for 37 years, now joins the long list of CEOs who have been pushed out since the credit crisis started slamming the financial services industry last year.

That list includes Citigroup's Charles Prince, Merrill Lynch & Co's Stanley O'Neal and Wachovia Corp's Ken Thompson.

Big losses

New York-based AIG - the world's biggest insurer with US$1.05 trillion in assets - lost US$7.8 billion during the first quarter of the year due to investments and contracts tied to bad loans.

The company operates in Jamaica through subsidiary American Home Assurance Company, headquartered in New Kingston.

AIG's first-quarter deficit was even more massive than its fourth-quarter loss of more than US$5 billion. After its two straight quarterly losses, the insurer revealed plans to raise US$20 billion in fresh capital - but investors reacted sceptically, unsure that extra cash would solve the insurer's problems.

Shares of AIG have fallen by more than 50 per cent over the last 12 months, closing at US$34.18 on Friday.

"In the coming months, we will conduct a thorough strategic and operational review of AIG's businesses and their performance," Willumstad said in a statement Sunday.