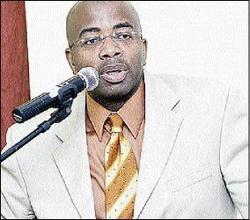

Curtis Martin, president of CCMB, says the bank is targeting a 50:50 mix of investment and loan assets.

Capital and Credit Merchant Bank (CCMB) is restructuring its portfolio of investments to strip away its low-yielding securities and replenish it with instruments of higher yields, under a programme scheduled to be wrapped up by the end of March 2008.

It's one of several measures that the bank has identified to reposition for growth in the year ahead, which also includes heavier concentration on the retail and corporate loans market to leverage business for the flagging company."We have more or less sold off most of those instruments so we are on target," CCMB president Curtis Martin told the Financial Gleaner."We are expected to see a significant reduction of our investment portfolio from this," he said.The company is restructuring its balance sheet and hopes to realignthe mix of investment to loans on a 50-50 split.CCMB last year lost more than a billion in value off its investment portfolio, which ended the financial year at $44.2 billion, down from $45.7 billion in 2006.

Less robust revenues

At year end December 31, 2007, CCMB, though profitable, was sporting far less robust revenues and net earnings than a year ago, signaling that its business continues to suffer from reduced spreads.CCMB not only grossed $600 million less revenues in the year just ended, falling from $6 billion to $5.4 billion, but its net interest income - a critical measure of business vibrancy - plus fees and commissions were also down by a combined $550 million to $1.4 billion.Operating profit plunged from $1 billion to $880 million, while at the bottomline, net profit was spliced by 38 per cent, from $772 million or earnings per share of $1.20 at December 2006 to $475 million in the current period or EPS of 74 cents.Still, in its year-ahead outlook, CCMB has not only signaled that it anticipates greater yields from its portfolio of GOJ global bonds, but more fundamentally, said the restructuring of its parent Capital & Credit Financial Group to refocus on banking as its core business, would allow it to "leverage its capital more effectively in direct banking business and other critical resource reallocations to improve productivity and service delivery."Martin said its bond portfolio was currently a drag on revenues, noting that it costs more to fund the instruments than the coupon on the bonds.

Products launched

Headquarters of the Capital and Credit Merchant Bank in New Kingston. - File

Martin said already a number of products have been launched, including credit facilities for the small and medium-size businesses and a hire purchase plan.CCMB's automated and internet banking platforms are also on a schedule for rollout March 2008, while a credit card is scheduled for launch later in the year.The company had a bumper year for loans, moving from $3.98 billion to $6.4 billion, but even at that level, loans remained overshadowed by CCMB's $44 billion investment portfolio, and accounts for a fraction of the $54.6 billion in total assets.The bank's healthier balance sheet, which rose from $52.8 billion, was largely due to loan growth but CCMB also recorded a more than $300 million improvement in its fixed assets.Its capital base was also strengthened by 6.6 per cent to $5.8 billion.Martin said the new CCMB branch for Ocho Rios should also boost growth plans."We should see significant expansion for the loan portfolio we have the infrastructure to so this," he said.

susan.gordon@gleanerjm.com