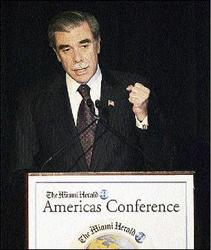

United States Commerce Secretary Carlos Gutierrez says the Bush administration is not happy with 0.6 per cent growth, making the economic stimulus plan even more urgent. - File

The economy of the United States nearly stalled in the fourth quarter with a growth rate of just 0.6 per cent, capping its worst year since 2002.

The U.S. Commerce Department's report on the gross domestic product, released Wednesday, showed an economy that had deteriorated considerably during the October-to-December quarter as worsening problems in the housing market and harder-to-get credit made individuals and businesses more cautious in their spending.

Fears of a recession have grown, even as inflation remained elevated.

For all of 2007, the economy grew by just 2.2 per cent, the weakest performance in five years, when the country was struggling to recover from the 2001 recession.

The housing collapse dealt the economy its biggest blow last year. Builders slashed spending on housing projects by 16.9 per cent on an annualised basis, the most in 25 years.

The report came as the Democratic-run Congress and the Bush administration continue to work on a programme of tax rebates and business incentives aimed at stimulating the economy.

"We are not happy with 0.6 per cent GDP growth," Commerce Secretary Carlos Gutierrez said in an interview with The Associated Press.

"We now need the full Congress to move forward as soon as possible because consumers - the American people - are waiting for that check and that is going to help them."

Senator Charles Schumer (D-NY) said when economic growth slowed as much as it did in the final quarter "alarm bells should be going off urging Washington to give the economy a good shot in the arm."

On Wall Street, stocks slid. The Dow Jones industrials were down around 35 points in trading around noon.

Half the pace

The fourth-quarter's performance was much weaker - half the pace - than economists were expecting. They were forecasting growth to clock in a 1.2 per cent pace.

"The economy has been subject to something of the perfect storm here.

It has been hit by the housing slump the credit squeeze, the subprime slime and stock price declines on Wall Street," said economist Ken Mayland, president of ClearView Economics.

"The economy is weathering some pretty stormy seas but it is weak."

The 0.6 per cent annualised increase in gross domestic product (GDP) marked a big loss of momentum from the third quarter's brisk, 4.9 per cent showing. The fourth-quarter pace was the slowest since the first quarter of last year.

The GDP figures come as worries mount that the country is on the verge of a recession or perhaps is already sliding into one.

To help bolster the economy, the U.S. Federal Reserve was poised Wednesday to again cut interest rates. An afternoon announcement was expected.

The administration remains hopeful that a recession can be skirted.

"We are not forecasting a recession," said White House spokesman Tony Fratto.

Instead, Gutierrez said: "We are looking at slower growth, and the indicators - the facts, the numbers we have at out disposal - suggest that is what we will see" for the first half of the year, the commerce secretary said.

He said the economy should return to a more solid growth rate in the second half.

The fragile economic situation has spurred rare cooperation among Democrats, Republicans and the White House to quickly enact legislation - including rebates - to stimulate the economy.

GDP measures the value of all goods and services produced within the United States and is the best barometer of the country's economic health.

Spending slowed

In the fourth quarter, consumer spending slowed to a pace of 2.0 per cent, down from a 2.8 per cent growth rate in the prior quarter. For all of last year, consumers boosted spending by 2.9 per cent, the smallest increase since 2003.

Businesses also watched their spending more closely during the final quarter of last year. Fearing a lessening appetite from their customers, they cut inventories of goods. That shaved 1.25 percentage points from fourth-quarter GDP, the most in a year.

Spending by businesses on equipment and software slowed to a pace of 3.8 per cent in the fourth quarter. For the year, such spending was up just 1.4 per cent, the worst showing since 2002.

Sales of U.S. goods and services abroad also slowed sharply in the fourth quarter. Exports grew at a 3.9 per cent pace, compared with a sizzling 19.1 per cent growth rate in the third quarter. That strong export growth was a key reason why the economy performed so well as a whole in the prior quarter.

For all of 2007, exports grew by 7.9 per cent, the slowest in two years.

Meanwhile, inflation picked up sharply during the final quarter. However, for all of 2007, it moderated slightly.

A gauge of inflation linked to the GDP report showed that 'core' prices - excluding food and energy — grew at a rate of 2.7 per cent in the fourth quarter. That was up from a 2.0 per cent rate in the prior quarter and was the biggest quarterly increase since the spring of 2006.

For all of last year, core prices went up 2.1 per cent, down from 2.2 per cent in 2006. The inflation figures are above the Fed's comfort zone - the upper bound of which is a 2.0 per cent inflation rate.

High energy prices are a double-edged sword. They can put a damper on growth and also stoke inflation, which would be a dangerous combination for the economy.

- A. P.