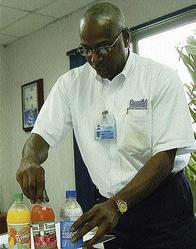

Andrew Reid, general manager of Pepsi Cola Jamaica, shows off three of the products manufactured at the company's Spanish Town Road plant. Susan Gordon, Business Reporter

After racking up an initial US$60 million debt on a long-term loan from parent PepsiAmericas when it purchased the soft drink business from Desnoes and Geddes in 1999, Pepsi Cola Jamaica Bottling Company Limited says it has paid off a substantial portion and is now in a position to generate real profit this year.

The company is barely above break even, after several years of losses, according to general manager Andrew Reid.

A portion of the borrowed funds, J$402 million, financed purchase of a 46,579 square foot property in Kingston, acquired from Desnoes and Geddes/Red Stripe to house Pepsi's manufacturing plant.

Payment for the 214 Spanish Town Road property was finalised late last year.

The company in the past six years has pumped about US$75 million of financing into the business, said Reid - comprising the US$60 million debt, plus another US$2.5 million annually - the bulk of which was invested in equipment, fleet and property.

Bringing down costs

This year, Pepsi will focus on bringing down its production costs.

"We only started making money over the last two years," Reid told the Financial Gleaner.

"We've had four years where we were paying backfor the investment afforded by our parent company. We broke even in 2005 with a little money in 2006 but we are poised this year to get ahead of the game and earn our keep."

Reid is banking on his cost reduction strategy, a more relaxed loan payment plan, and a growing beverage market as the right formula to put Pepsi Jamaica into profit mode.

With 75 per cent of its expenses linked to manufacturing and distribution - outside of labour and water, Pepsi imports everything else - the company outsourced its distribution operations to Red Stripe last December in the first stage of its cost-cutting strategy.

"We've moved the needle quite a bit from what was a straight loss to break even," said Reid.

But with inputs constituting a major component in Pepsi's manufacturing cost structure, compounded by a depreciating Jamaican dollar, Reid said he is focusing on upgrading equipment to increase throughput to generate greater economies of scale.

"We had heavy overheads to maintain the trucking service. It was one of many things we've had to look at to move our profits," he said in reference to the distribution changes made last year.

The loan from Pepsi Americas required heavier servicing costs in the first five years, which the local subsidiary has now hurdled, but has a more relaxed payment structure for the remaining period.

"It is a very long date I wouldn't want to put out," said Reid referring to the debt repayment schedule.

"Matters related to debt and capital investment is not something I'm privileged to speak to given the structure of the company," he told the Financial Gleaner.

Reid also would not comment on the company's earnings.

But, given his claim of a 65 per cent market share in a soft drink market that consumes 12 million cases per year, and assuming a unit price of US$8 per case, its turnover would, by conservative Financial Gleaner estimates, amount to US$62.4 million or J$4.2 billion on that segment of the beverage market alone.

Margins on soft drink, he said, are about 2.5 per cent on invested capital.

Ability to increase revenue

Inside the Pepsi Cola Jamaica plant, 214 Spanish Town Road, Kingston. Pepsi Jamaica paid Red Stripe $402 million for the property. - photos by Junior Dowie/Staff Photographer

"Our ability to increase revenue or raise prices is sealed in by what you can charge the consumer," said the beverage executive.

Nevertheless, he noted that the company's market continues to expand, with 20 per cent growth year to date, relative to the matching period last year.

For calendar 2006, the business grew 12 per cent, one point above its 2005 performance of 11 per cent.

Pepsi, the flagship brand, now has 86 per cent of the cola market and is sold by 95 per cent of local soft drink retail outlets.

However, the growth of the business has also been aided by the performance of other brands in the non-carbonated sector.

Its Essential water is said to be number four on the market, while its Tropicana and Gatorade brands have experienced 100 per cent and 50 per cent growth, respectively.

Pepsi, which dedicates only 12 per cent of its volume to export - it sells Ting, Ginger Beer and five D&G flavours to overseas markets - said this operation rakes in 25 per cent of the total revenue generated by the company.

Packaged in glass bottles

Most of the exports are packaged in glass bottles, which Reid said was expensive to produce and constituted only 15 per cent of output.

The company this year has doubled its annual capital investment to US$5 million to increase capacity on its bottling line.

"The bottling line should increase our throughput without increasing the other operational costs at the same time rate. Your energy and labour costs are pushed down relatively to your per unit cost. If you achieve low cost, you can drive volume and utilise assets," said Reid.

With the expansion, Pepsi also plans to boost its warehouse facility and is banking on distribution partner Red Stripe to follow suit on the space it owns.

Pepsi Jamaica's waste factor is less than 2.0 per cent, which Reid said is industry standard.

susan.gordon@gleanerjm.com