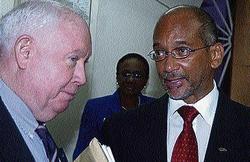

Attorney Chris Bovell (left) and GraceKennedy CEO Douglas Orane in discussion at the conglomerate's annual general meeting held Monday at its corporate offices on Harbour Street, Kingston. - Winston Sill/Freelance Photographer Ashford W. Meikle, Business Reporter

Despite an objection raised from the floor, GraceKennedy shareholders on Monday gave directors the go-ahead to impose sanctions on shareholders who decline to disclose the beneficial or true owners of GraceKennedy stock.

The proposed penalty is an anti-money laundering safeguard, according to CEO Douglas Orane.

"We see this provision as important in today's environment where money launderers are seeking innovative ways of disguising the funds from their illegal activities because legislation has focused on activities within banks and other financial institutions," said Orane at the company's annul general meeting where the resolution was passed.

"The risk is that shareholders of the company could one day find that a significant portion of the shares are being held by persons who are in fact laundering illegal funds in this way. These provisions should serve as a deterrent for such activities."

According to the resolution, should a shareholder fail to make a declaration, he would be denied voting at an annual or extra-ordinary general meeting as well as have dividend payments withheld.

The amendment was opposed at the AGM by shareholder John Jackson, who argued that the resolution should establish a minimum number of shares for the disclosure.

His motion was declared null and void.

"My understanding is that you cannot have an amendment from the floor because it has been circulated already and therefore it has to go to a vote. What one can do is to vote for or against it," said Orane.

"If you aregoing to go into partnership with someone else - no matter how small that partnership - you want to know who your partners are," the CEO emphasised to shareholders.

But Jackson argues that the amendment to the GraceKennedy's articles of incorporation - particularly since it establishes a zero minimum - removes power from the hands of shareholders.

"It hands too much control and power to the hands of directors. You may find that now you have one set of directors who are honest and straightforward and in the future you could have a set of directors who have sinister motives," Jackson told Wednesday Business yesterday.

"There is no justification for it to be at zero. When you have a minimum - the minimum not being zero, it gives the directors the opportunity to come back to shareholders and ask for and justify a revision."

Orane also reiterated his support for the resolution, also in discussions with Wednesday Business, and played down Jackson's concerns.

He insisted that the directors have to adhere to the company's corporate governance and code of ethics.

"The 20 largest companies on the London Stock Exchange have adopted this policy and Sagicor has done it as well; so we are patterning ourselves off these companies," defended Orane. "We are doing it voluntarily. It is in the best interest of shareholders."

GraceKennedy is the first company on the Jamaica Stock Exchange to propose the change to its articles.

ashford.meikle@gleanerjm.com