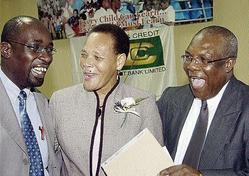

Ruel Reid (left), immediate past president of the Jamaica Teachers' Association (JTA), shares a joke with Hopeton Henry (right), president of the JTA, and Ena Barclay, president-elect of the JTA. The occasion was the official launch of the Teachers' Registration Programme and the Teachers' Professional Development Loan Fund, held yesterday at the Hilton hotel, New Kingston. The revolving loan fund will take effect on June 1, and teachers are expected to be registered by August 2009. - Rudolph Brown/Chief PhotographerPetrina Francis, Staff Reporter

After seven months of waiting and the deregistration of scores of educators from tertiary institutions because of non-payment of fees, the much-anticipated $500 million revolving loan fund for teachers was finally launched yesterday.

The loan, which is aimed at promoting professional development for the island's more than 17,000 teachers who are without a first degree, is to take effect June 1.

"We have had some difficulties over the period but today I can say - finally," said Hopeton Henry, president of the Jamaica Teachers' Association (JTA), while addressing the gathering at the launch, held at the Hilton Kingston hotel, New Kingston.

Task Force recommendation

In 2005, Prime Minister P.J. Patterson announced at the People's National Party (PNP) annual conference that the Government would be implementing a $500 million revolving loan fund to upgrade the qualifications of the island's teachers who are without a first degree. This was in keeping with a recommendation made by the Task Force report on education.

The JTA has been promised the loan fund on three different occasions: last October andNovember, and January this year.

In her remarks yesterday, Education Minister Maxine Henry-Wilson said the launch of the revolving loan fund will go a far way in providing much-needed financial support to teachers.

"I am excited about the possibilities for this and anticipate the great impact that this will have in our quest to improve teaching and learning in Jamaica," she said.

ABOUT THE FUND:

Loans from the fund are provided for courses leading to a Bachelor's degree or a Postgraduate Diploma in Education.

The fund is administered by Capital & Credit Merchant Bank (CCMB) on behalf of the Ministry of Education and Youth. CCMB will be providing $100 million to the pool.

Applications are to be submitted through the Regional Office of the region in which the applicant's school or employment is located.

Teachers who study part-time or who are not on paid study leave can access 90 per cent of the fund.

Teachers who are on study leave with pay can only access 50 per cent.

Each applicant is required to:

Be a teacher in a public educational institution.

Be permanently employed by the Ministry of Education and Youth.

Provide proof of acceptance from an accredited institution.

Submit last two pay slips.

Provide job confirmation letter indicating his/her employment status.

Meet debt service of 1.5:1 (i.e., salary after deduction of fixed commitments should be at least one and a half times the required monthly payment under this loan facility).

Provide proof of 10 per cent equity towards the course of study, among other things.

The applicant is advised that:

Interest rates on the loan will be 7.75 per cent on the reducing balance;

Loans are provided unsecured to qualified applicants;

An amount equivalent to one month's payment must be placed in funding account or liquidation account prior to disbursement of the loan. This amount can be deducted from the loan amount.