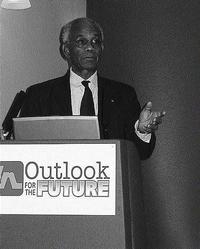

Cabinet Secretary Dr. Carlton Davies participates in a JNBS-sponsored seminar in the United Kingdom last December. JNBS outpaced the building society sector with growth of 22 per cent, compared to the average 21 per cent, according to new data published by regulator, Bank of Jamaica. - ContributedAshford W. Meikle, Business Reporter

Jamaica's building societies grew loans by $7.5 billion last year, new central bank figures suggest, contributing to a 21 per cent increase in the societies' mortgage stock as interest rates fall and the lenders compete among themselves for market.

Combined, the country's four building societies had an asset base of $106 billion at the end of December, an 18 per cent year-over-year increase, with loans and advances totalling $43.3 billion compared to the $35.8 billion recorded in December 2005.

In comparison, the societies have almost $38 billion invested in securities offered by the government, Bankof Jamaica, other public sector bodies and other counter parties.

Only two of the building societies recorded growth above the industry's 21 per cent - Jamaica National and FirstCaribbean.

With a mortgage portfolio of just over $20 billion, or 47 per cent of the total mortgage stock, the country's largest building society, Jamaica National Building Society saw its portfolio increase by 22 per cent.

Its direct competitor and No. 2 in the market, Victoria Mutual Building Society (VMBS), experienced 10 per cent growth and now has a mortgage portfolio of $14.6 billion. In order to grow its portfolio, VMBS recently introduced a new marketing campaign, offering 100 per cent financing for home purchases.

In fact, both competitors have been concentrating their marketing on the low interest rates now being offered - 12.99 per cent, a significant drop from the 19 per cent that was being offered a couple years ago.

With a portfolio of just $4.3 billion, FirstCaribbean accounts for just 10 per cent of the total mortgage stock. However, it experienced an 89 per cent increase in its year-over-year figures, which has been attributed to two main products - its international mort-gages and its foreign currency mortgage.

Scotia Jamaica Building Society saw its mortgages climb by 14 per cent, and now has a portfolio of just over $4 billion.

Growth in customer deposits across the four building societies lagged behind that of loans and advances. Combined customer deposits total $73.6 billion, a 15 per cent increase year on year.

ashford.meikle@gleanerjm.com.