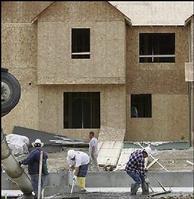

Workers pour a concrete foundation at a housing development in a Denver, Colorado suburb, last year. Sales of new homes plunged 10.5 per cent in February, the biggest drop in nearly nine years, while prices fell and the number of homes on the market hit a record high, the government said on Friday in a report signalling significant slowing in the housing market. - REUTERS REUTERS:

SALES OF new U.S. homes plunged 10.5 per cent in February, the biggest drop in nearly nine years, while prices fell and the number of homes on the market hit a record high, the government said on Friday in a report signalling significant slowing in the housing market.

A separate report suggested weakness in business spending plans, with new orders for durable goods outside the volatile transportation sector falling short of forecasts.

The data sent the dollar to session lows against the euro and pushed U.S. Treasury prices higher as Wall Street bet the Federal Reserve's campaign of interest-rate hikes could be near its end.

"This is what the Fed wants, they want housing to slow -- that is the place where they can most effect wealth creation and spending," said Robert MacIntosh, chief economist at Eaton Vance Management in Boston. "The Fed is that much closer to being done. I think they are done after next week."

BORROWING COSTS

The Federal Reserve's policy-setting committee meets on Monday and Tuesday, when it is expected to raise borrowing costs for the 15th straight time since June 2004.

According to the Commerce Department, the pace of new single-family home sales slowed to a 1.080 million unit annual rate in February from January's downwardly revised 1.207 million unit rate.

Economists had expected new home sales to decline to a 1.200 million unit rate from January's originally reported 1.233 million unit pace.

Friday's report on new home sales followed data on Thursday showing surprising strength in the pace of home resales.

But the data measure different things, and reflect distinct timing in home buyers' purchase decisions. Existing home sales figures reflect closings, which can occur more than a month after a purchase decision is made, but new home sales data are recorded when contracts are signed.