By Andrew Green, Staff Reporter

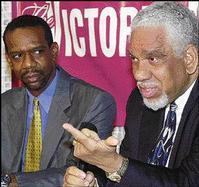

Victoria Mutual Building Society (VMBS) president and Chief Executive Officer Karl P. Wright (right), gestures to the audience during a press conference on Friday at the VMBS training centre in St. Andrew. Christian Stokes, vice-president for business development, looks on. - Ian Allen/Staff Photographer

MANY PEOPLE will get less than they are expecting from their property insurance following the destruction wrought by Hurricane Ivan, said Victoria Mutual Building Society's (VMBS) president and Chief Executive Officer Karl P. Wright.

To deal with the anticipated financial problems, VMBS has allocated $300 million for loans to persons whose homes were seriously damaged, the VMBS executive said at a press conference on Friday.

RECONSTRUCTION EFFORT

An additional sum of $400 million is to be loaned to the Jamaica Mortgage Bank for housing finance purposes and an additional $5 million is being donated to the reconstruction effort.

"The payout from the insurance industry is not going to be as liberal as it was in past years," Mr. Wright said at the VMBS training centre in St. Andrew. "That is the end game for the average clause and what they call the excess which is deductible up front."

AVERAGE CLAUSE

With the application of an average clause, the payout for damage is made proportionate to the level of coverage of the property, insurance experts told Sunday Business. The payout is further reduced by the fact that only damage above a two per cent 'excess' amount will be paid by the insurer.

"Hurricane Ivan represents the first catastrophe to have struck Jamaica since the introduction of the average clause in respect of residential property," said Frank Harrison, senior vice president for credit. The average clause had been applied only to commercial properties previously.

"This is the first test we will face," Mr. Harrison said. "Some property owners chose not to insure or to insure partially and with the average clause, I am sure that many persons will need special loan assistance in order to recover."

Victoria Mutual expects that some individuals will thus come up short with their financing requirements. Mr. Wright said, "Hence the nature of the response to fill the gap and ease the pressure."

``The $400 million loan to the Jamaica Mortgage Bank is geared towards increasing the housing stock which may have been depleted by the hurricane, Mr. Wright said. This will improve overall supply of housing all over the island.

```With the $300 million loan facility, Mr. Harrison said, "We have given preferential treatment to our existing borrowers."

``VMBS clients will be able to seek assistance to finance repairs to buildings affected by hurricane and refinance their debts, Mr. Harrison said. Assistance for repairs will be available at between 12 per cent and 16 per cent per annum while debt consolidation loans will be available at 19 per cent per annum.

``"We will entertain requests for suspension of mortgage repayments for up to 3 months for persons suffering major dislocation," Mr. Harrison said. "This will be done on a case-by-case basis."

``The company will also consider waiving penalties on mortgage payments that were not in arrears prior to the hurricane.

``For new mortgagors, "We will entertain requests for loans up to 75 per cent of value for periods up to 25 year to finance repairs," Mr. Harrison said. "Interest will be at 18 per cent per annum."

``Debt consolidation loans for new customers will be available at 20 per cent per annum, Mr. Harrison said.

```Christian Stokes, vice president for business development said Victoria Mutual is in the process of launching a promotional campaign in Jamaica, the United States, Canada and the United Kingdom to encourage deposits to the accounts which were opened on behalf of Food for the Poor, United Way, the Adventists Development and Relief Agency (ADRA) and St. Patrick's Foundation. The account numbers are 22853998, 22772867, 22056170 and 22810352 respectively.

``Additionally VMBS has also set up a National Disaster Relief Fund. Contributions to this fund will be forwarded to the government to assist the national reconstruction effort. The account number is 22911911. Persons living in the UK and Canada will be able to make contributions free of charge using VMBS Vlink Money Transfer up to October 31, 2004.