By Andrew Green, Staff Reporter

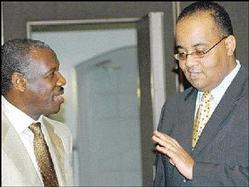

Gladstone Whitelocke (right), general manager of Scotia Jamaica Building Society (SJBS), gestures to William Clarke, managing director of the Bank of Nova Scotia Jamaica Limited. They were participating in the Mortgage Switch Programme launch by SJBS at the Jamaica Pegasus Hotel in St. Andrew on Wednesday. - Rudolph Brown/Staff Photographer

WANT A mortgage at the rock bottom building society rate of 13.375 per cent?

Scotia Jamaica Building Society (SJBS) has one for you. But the catch is that you must already have a mortgage.

Their new Mortgage Switch Programme is exactly what it says. It is a $300 million pool of funds which gives you an enticing incentive to change your mortgage lender.

"This special Switch Programme offers a very attractive low rate," said Bank of Nova Scotia Jamaica Limited managing director William Clarke. He said it was, "the lowest rate in the market for a building society.

That 13.375 per cent rate is fixed for two years, Mr. Clarke said. He spoke at the Switch launch at the Jamaica Pegasus Hotel in St. Andrew on Wednesday.

The amount that may be refinanced starts at $4 million and covers loans up to $7.5 million. Sums above that are refinanced at 17.75 per cent per annum, which is around regular market rates.

A further incentive to Switch is that SJBS offers to waive half the standard costs involved in shifting a mortgage from one institution to another. "The Switch programme through SJBS will again give us a competitive advantage," Mr. Clarke said. "It is a part of the strategy within the Scotiabank group to target specific segments of the market to grow your business and this is one such."

The persons targeted would already have an established credit history, would have had some experience in dealing with other credit institutions, he said. The target group would not generally be new homeowners. "The total market for residential mortgages is about $15 billion," he said. "Our market share is in the region of about 12 per cent."

Jamaica National Building Society (JNBS), Victoria Mutual Building Society (VMBS), Scotia Jamaica Building Society and FirstCaribbean Building Society are the four building societies in the market. Jamaica National is the largest with about 46 per cent of the sector assets.

A savage cycle has taken place in the sector over the last two decades. Four companies in the 1980's blossomed to six in 1990 and 25 by 1995, according to the Economic and Social Survey of Jamaica. The fallout in the financial sector brought that number down to five in 2000 and four presently.

Given the high construction costs, Hanover Benefit Building Society chairman Percy A. Miller said in 1991, that their "low" mortgage rates of 18 per cent was not sufficient to bring in new customers. He therefore encouraged the directors of the society to act as "salesmen" and convince more people of the good terms available.

Hanover Benefit was eventually incorporated into Jamaica National in 1996.

Scotia Jamaica Building Society is a subsidiary of the Scotiabank Jamaica Group. The Society's products and services are made available through Scotiabank's network of 42 branches in Jamaica.

"Offering of this Switch Programme signifies the dynamic synergy within the Scotiabank Group which we always leverage to ensure the market receives tangible benefits from its interaction with us," Mr. Clarke said.

The performance of Scotia Jamaica Building Society over the past ten years, he said, "clearly demonstrates its ability as a fairly new player in the market, to bring successful strategies to the industry.