Rio Tinto espionage charge complicates China iron ore talks - World steel hostage to drama

Published: Wednesday | July 15, 2009

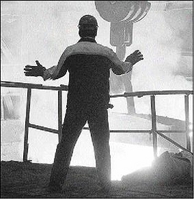

In this June 26 photo a steel worker labours at a small-scale steel plant in Shenyang in northeast China's Liaoning province. The detention of four Rio Tinto Ltd employees has thrown a complication into already contentious price talks between China and iron ore suppliers that have produced no deal two weeks after the last supply contracts expired. - FILE

Executives of five Chinese steelmakers are being questioned in a widening espionage probe of four detained Rio Tinto Ltd employees, news reports said Tuesday, as Australia pressed for details of the case.

The Rio employees, including an Australian, were detained July 5 amid iron ore price talks with Chinese steel mills.

State media say they are accused of bribing Chinese steel company employees to obtain confidential information on China's negotiating position in the talks.

The chief iron ore negotiator for Baosteel Group, China's biggest steel producer, was questioned but allowed to return to work, the newspaper 21st Century Business Herald said. It gave no indication whether he was suspected of wrongdoing.

Executives of Anshan Iron and Steel Group, Laigang Group and Jigang Group also are under investigation, the China Daily newspaper reported. It gave no other details. An executive who oversees iron ore purchases for major steelmaker Shougang Group was detained last week, according to news reports.

Spokespeople for Shougang and Anshan said they had no information. Phone calls to Baosteel spokespeople were not answered.

The spying accusations against the manager of Rio's Chinese iron ore business and three co-workers is now complicating already contentious price talks between China and iron ore suppliers that, without an agreement, could disrupt the global industry.

China consumes up to 60 per cent of global iron ore supplies and wants deep price cuts after two years of steep increases.

The talks have produced no deal two weeks after the last contracts expired.

Analysts say an extended period without an agreement could force miners and Chinese mills to change production and investment plans, affecting companies as far away as Brazil and Australia.

"There is no progress in the price talks so far," said a spokesman for the China Iron and Steel Association, an industry group that is negotiating for the Chinese side.

He would give only his surname, Yang.

"Negotiations are still under way."

Spokespeople for Rio, the Anglo-Australian mining giant that is leading negotiations for iron ore suppliers, declined to comment.

The other major suppliers are BHP Billiton Limited and Brazil's Vale SA.

"It's difficult to see how the two sides can still talk or negotiate, given the events of the last week," Martin Ritchie, Asia editor of the industry journal, Metal Bulletin, said in an email.

"It's going to be difficult for Rio to negotiate when a key member of their team in China is locked up."

The Chinese association declined to comment on whether the accusations against the Rio employees prompted its negotiators to change their strategy.

The detentions have thrown the spotlight on the normally obscure iron ore talks and China's rapidly growing dominance as the main global customer.

Without a new price agreement, China's mills can rely temporarily on iron ore stockpiles and can buy on the global spot market, said Peter Strachan, an independent industry analyst in Perth, Australia.

But he said spot prices are higher and the market is too small to satisfy China's voracious demand.

China's iron ore consumption has grown explosively as steel mills supplied booms in manufacturing, shipbuilding and construction. That brought a windfall to Australia, Brazil and other suppliers.

Without Chinese buyers locked into long-term contracts, iron miners will be reluctant to make investments of up to US$200 million per project needed to guarantee future supplies, Strachan said.

Some production expected this year already has been delayed to 2010 or 2011 because miners put off spending due to the global financial crisis, he said.

"Any sustained period of insecurity for the suppliers would lead to a worse situation for the customers - steel mills around the world," Strachan said.

Iron ore suppliers boosted prices by 74 per cent last year, triggering howls of protest from China. That was on top of a 31 per cent increase in 2007.

Global iron ore sales last year were 850 million tons, and China accounted for about 450 million tons.

While the global slump might dent this year's demand, China's share of the total could rise because of a renewed building boom fed by government stimulus spending at a time when other economies are slumping.

Rio announced May 26 it had agreed with Japanese and South Korean mills to cut this year's price by 33 per cent.

But the Chinese steel association broke with tradition and rejected that as the benchmark for its own prices, showing China's growing confidence in its clout as an iron ore customer.

News reports said the Chinese group, whose 119 members represent 90 per cent of China's output, wants a 40 per cent price cut.

The group declined to confirm that but said the prices agreed with Japan and Korea would cause losses for Chinese mills.

China relies on imports for nearly all its iron ore and is trying to organise its steel mills to increase its leverage over suppliers. The government opened an iron ore exchange in May in the eastern port of Rizhao, a major ore importing centre, and is trying to stop speculative trading of iron.

Chinese authorities also are talking about pursuing more flexible conditions such as six- or three-month contracts.

That would let buyers bet that prices might fall before the next renegotiation.

On Monday, Australia's government called in the acting Chinese ambassador and pressed for details about the case against the detained Australian, Stern Hu, Foreign Minister Stephen Smith said.

Australia has warned the affair could discourage foreign companies from doing business in China.

"We have again pressed Chinese officials yesterday to do two things: firstly to provide us with more detailed information about the circumstances relating to Mr Hu's detention, and secondly, to urge them that this is a matter that needs to be dealt with expeditiously," Smith told Australian Broadcasting Corp radio.

The Chinese government has confirmed that Hu and his co-workers are accused of "stealing state secrets" but has given no details.

A Chinese foreign ministry spokesman tried Tuesday to reassure foreign investors, saying the affair was an "individual judicial case" and would not affect business conditions.

"This is not to say that China is going to restrict foreign corporations," spokesman Qin Gang said. "China will continue to provide good conditions for foreign companies and their investment in China."

- AP