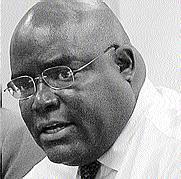

Brian George, president and CEO of Supreme Ventures Limited. - File Susan Gordon, Business Reporter

Supreme Ventures Limited's profit projections were well below expectations, pulled, said the company, by its loss-making gaming lounge, Acropolis.

Its net profit of $165.3 million was 62 per cent below earnings projected.

President and CEO Brian George said the company's liquidity problems were attributable to the marketing cost of putting out the initial public offering for the company to list on the Jamaica Stock Exchange and the $110 million in losses from the Acropolis which put a strain on the cash reserves.

Head of communications Sonia Davidson said the slot machine side of the business at Acropolis contributed largely to the $110 million loss.

George, in his statement to shareholders that accompanied SVL's annual report filed with the stock exchange this week, advised of the new subsidiary created to bring the group back in line with liquidity ratios required by its licence.

Current assets

At the end of its third quarter in July 31, 2006, SVL's current assets were 60 per cent of current liabilities, or 15 per cent below the condition of its licence by BGLC which demands that its liquid assets be at least 75 per cent of current liabilities to ensure the company has sufficient cash or liquid resources from which to pay out prizes.

At that time, George said the $536 million expenditure to acquire Coral Cliff Hotel in Montego Bay and Prime Sports, and another $421 million in long-term receivables had impacted negatively on the cash flow for the previous financial year which was carried over into the 2006 financials.

SVL spent another $980 million repaying loans, including $281 million to directors who had financed a $277 million loan the year before to the company. SVL's long-term liability dipped to $93 million in 2006 from $124.8 million in 2005, representing a 24.7 per cent decrease.

The new subsidiary, Supreme Ventures Lotteries Limited (SVLotteries) now has the licence to operate Cash Pot, Lucky 5, Dollaz, Pick 3, Lotto and a variety of instant games as at January 1, 2007.

It is also expected to maintain 100 per cent of the prize liabilities (payments) along with liabilities to GTECH fees and electronic Phone Pins, government taxes, and BGLC fees and contributions which were included in the ratio calculation.

The group's revenue increased by $1.6 billion to $15.9 billion reflecting an 11 per cent increase over year 2005 while operating profit increased from $219 million in 2005 to $ 256. million in 2006 an increase of 17 per cent.

susan.gordon@gleanerjm.com