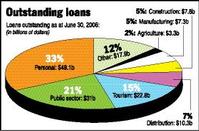

Bank lending to individuals, which stood at $49.1 billion across commercial banks and other financial institutions at the end of June this year, surpassed loans to the public sector, to take the highest share of loans outstanding at 33 per cent.

At the same time, financial institutions, particularly near-banks have benefited from a shift in focus towards loan provision to overseas residents.

This more than doubled, moving from $333.5 million as at June 30 last year, to $691 million at the end of June this year.

Overall, personal loans outstanding grew from $36.5 billions to $49.1 billion over the 12-month period, a 35 per cent increase.

Loans to the public sector actually fell by 16 per cent over the period under review, from $37.5 billion to $31.4 billion, or 21 per cent of all loans in issue across commercial banks and other financial institutions.

At $150 billion, loans outstanding at the end of June were 12.7 per cent higher than June end last year.

The tourism sector, which continues to be the third largest holder of bank loans (15 per cent), saw a 35 per cent increase in loans to $22.8 billion.

This was followed by distribution sector (seven per cent), which increased its debt to financial institutions by 18 per cent to $10.3 billion, over the period.

The construction sector, which held five per cent of loans of $7.8 billion as at June 30, 2006, was flat over the previous year's June end, while loans to the manufacturing sector increased by 42 per cent to $7.3 billion.