Hopeton Morrison, Contributor

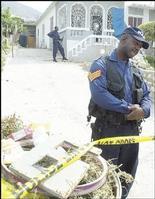

A reminder of the need for estate planning. A policeman stands guard at a murder scene in the community of Bayshore Park, St. Andrew, in April. - RICARDO MAKYN/STAFF PHOTOGRAPHER

THE BRUTAL slaying of three policemen last week highlights in no uncertain way the need for estate planning. The obvious question is: What does personal financial planning have to do with one's death?

It hardly makes sense to make material provisions for all aspects of your financial independence and at a time in your life when you become incapacitated because of illness or age you are forced to live and die in a state of indignity. Recently, we were inundated with details of the deaths of two famous figures and another whose profile was raised because of the publicity surrounding her case. We refer of course to the late Pope John Paul II, Johnny Cochrane and Terri Schiavo.

Pope John Paul II chose not to go back to hospital in his last days because he was both conscious enough to make that decision and those around him honoured his wish. Johnny Cochrane chose to keep his illness a secret up to the point of his death. Unfortunately for Terri Schiavo, her 15 years on life support and eventual death created deep divisions in her family.

We believe that if you have been careful in preparing yourself for lifelong financial independence you would also want to ensure the same degree of independence and dignity in incapacitation and death. In that regard, it is pointless putting aside funds for that purpose without the corresponding legal documentation and authority transferred to a trusted friend or family member.

Alzheimer's disease, strokes, and cancers all represent illnesses that create varying levels of incapacitation. With the Kingston and St. Catherine Corporation now laying down very serious requirements for even the private care of persons in your own home, everyone should engage in this aspect of estate planning.

DOCUMENT

A common document that local financial institutions often require persons to complete is a Power of Attorney. This document allows a friend or family member to act on a transaction in your interest. The 'attorney' assumes a legal right to make certain decisions that you would make yourself if you were able to. Overseas based clients of financial institutions often use this document to specify someone to transact business on their behalf in their absence. A Power of Attorney, however, is revoked if a person becomes physically or mentally incapacitated.

With hundreds of thousands of Jamaicans residing all over the world, some of us may be exposed to two other related documents that although not legally binding in Jamaica, would be of importance nonetheless. A Durable Power of Attorney ensures that the 'attorney's' legal right to act is not revoked where the signer becomes incapacitated and remains a valid document as long as the principal is alive unless it is revoked by him or her.

The other document, the Living Will, is a written statement that indicates clearly that the signer has no desire to be kept alive by life support in the event of a terminal illness especially where the prognosis shows almost no chance of recovery.

If then, you or your loved ones at home and abroad have spent a lifetime working hard for financial independence, it is crucial that you engage in the legal process to protect yourself and those you love in the event of serious incapacitation and death. Preservation of one's dignity in illness and death should not be left to chance.

Hopeton Morrison is general manager of St. Thomas Cooperative Credit Union Ltd. and lecturer in the School of Business Administration at the University of Technology. Please send comments and questions to: hmorrison@stccu.com